Introduction:

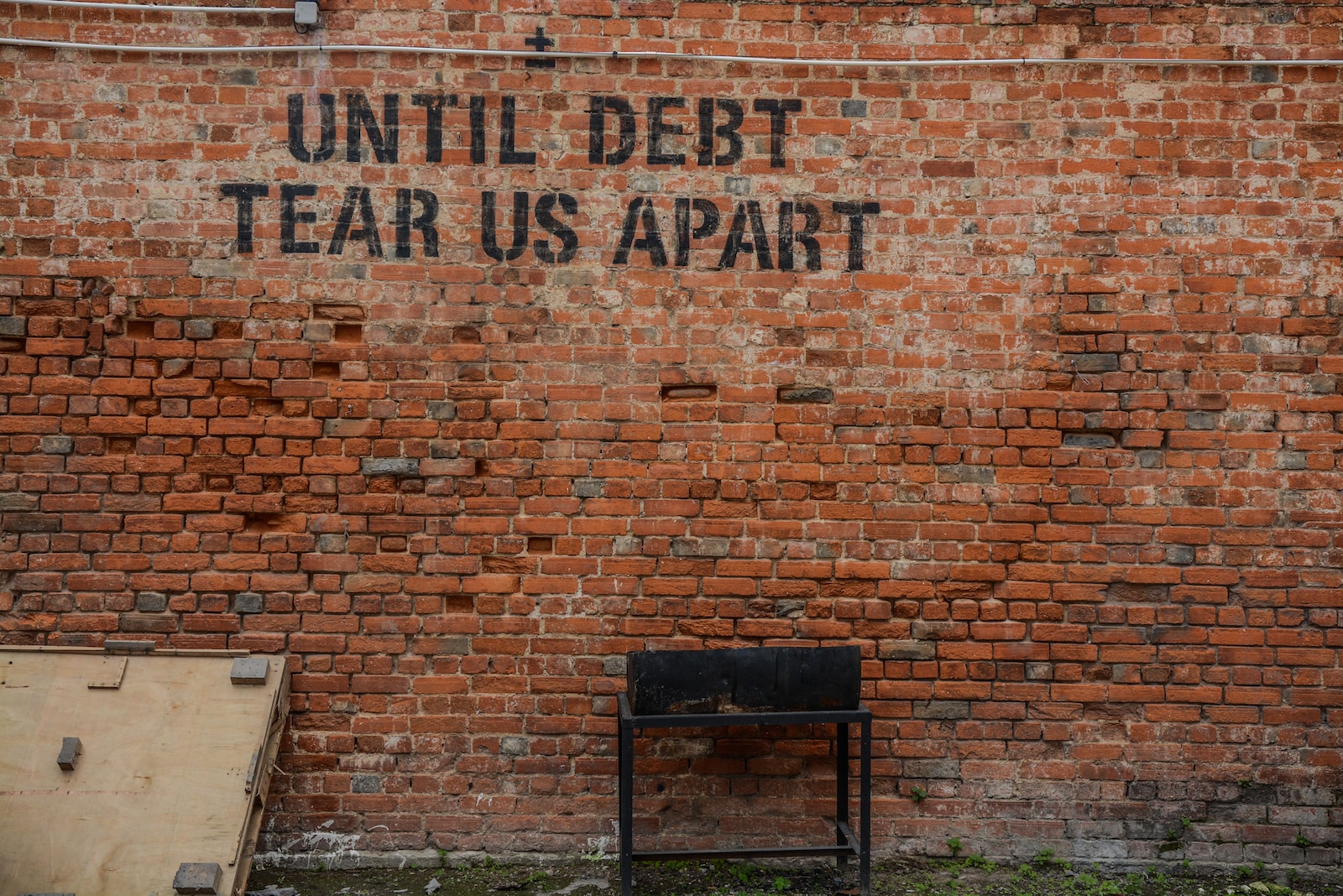

In today’s fast-paced world, where financial pressures often loom large, many individuals find themselves entangled in the web of debt. Escaping the clutches of debt requires a combination of discipline, strategic planning, and a commitment to making lasting financial changes. In this article, we will explore ten effective ways to break free from debt and pave the way toward financial independence.

1. CREATE A DETAILED BUDGET:

Creating a detailed budget is the cornerstone of any effective debt repayment strategy. By meticulously listing your income, expenses, and debt obligations, you gain a holistic view of your financial landscape. This clarity allows you to identify patterns in your spending habits and pinpoint areas where you can make adjustments to free up more funds for debt repayment.

Moreover, a detailed budget serves as a roadmap for your financial journey. It helps you prioritize your expenses, distinguishing between necessities and luxuries. Through this process, you can identify unnecessary expenses that can be trimmed or eliminated altogether. By reallocating these funds towards debt repayment, you accelerate your progress towards financial freedom.

Furthermore, a budget provides a sense of control and empowerment over your finances. It transforms abstract financial goals into tangible action plans, making the daunting task of debt repayment more manageable. By adhering to a budget, you develop discipline in your spending habits and cultivate healthy financial behaviors that contribute to long-term stability. In essence, creating a detailed budget sets the foundation for a successful journey towards debt freedom, empowering you to take charge of your financial future.

2. PRIORITIZE DEBT REPAYMENT:

Prioritizing debt repayment is essential for effectively managing your financial obligations and achieving debt freedom. By developing a strategic plan, you can focus your resources on tackling debts in a systematic and efficient manner. High-interest debts, such as credit card balances or payday loans, often come with exorbitant interest rates that can significantly inflate the total amount owed over time. Therefore, it makes sense to prioritize these debts first, as eliminating them early can save you substantial amounts of money in interest payments.

Additionally, prioritizing high-interest debts allows you to experience tangible progress sooner in your debt repayment journey. As you pay off these debts, you’ll experience a sense of accomplishment and motivation that can fuel your momentum towards tackling other debts. This positive reinforcement can be crucial for staying committed to your repayment plan, especially during challenging times.

Furthermore, by prioritizing debt repayment, you’re making a proactive effort to improve your financial health and stability. As you eliminate high-interest debts, you free up more financial resources that can be redirected towards other financial goals, such as saving for emergencies or investing for the future. Ultimately, prioritizing debt repayment is a strategic approach that not only saves you money but also sets you on the path towards long-term financial success and freedom.

3. EMERGENCY FUND:

Establishing an emergency fund is a pivotal aspect of financial planning, serving as a safety net to cushion unexpected financial blows. It acts as a buffer against unforeseen circumstances, allowing you to cover expenses without resorting to borrowing, thus preventing a spiral back into debt. With an emergency fund in place, you gain peace of mind, knowing that you have a reserve to tap into when faced with emergencies like medical bills, car repairs, or sudden job loss.

Furthermore, an emergency fund contributes to financial resilience by safeguarding your progress towards debt freedom. By having a designated pool of funds for emergencies, you can continue your debt repayment journey uninterrupted, avoiding setbacks caused by unexpected expenses. This financial stability not only accelerates your path to debt freedom but also instills a sense of confidence and control over your financial future.

In essence, prioritizing the establishment of an emergency fund is a strategic move towards building financial security and resilience. It empowers you to navigate life’s uncertainties with confidence, ensuring that you remain on track towards achieving your long-term financial goals.

4. NEGOTIATE WITH CREDITORS:

Negotiating with creditors can be a powerful tool in your debt repayment arsenal, potentially offering significant savings and more manageable repayment terms. Many creditors understand that borrowers may face financial difficulties and are often willing to negotiate repayment plans or adjust interest rates to facilitate debt settlement. By initiating discussions with your creditors, you demonstrate your commitment to fulfilling your obligations and taking proactive steps towards debt resolution.

One of the most impactful negotiation strategies is to request a reduction in interest rates. Lowering the interest rate on your debts can result in substantial savings over the long term, reducing the total amount you need to repay and making monthly payments more affordable. Additionally, negotiating for extended repayment periods or alternative payment plans can help ease the burden of debt repayment, providing you with greater flexibility and breathing room in your budget.

Moreover, engaging in negotiations with creditors can foster a sense of empowerment and control over your financial situation. By actively seeking solutions rather than passively accepting the terms set by creditors, you assert yourself as a responsible and proactive borrower. This can lead to more favorable outcomes and ultimately accelerate your journey towards debt freedom.

5. GENERATE ADDITIONAL INCOME:

Generating additional income is a proactive approach to accelerating your debt repayment journey and achieving financial freedom sooner. By exploring opportunities to supplement your primary source of income, such as taking up part-time employment, freelancing, or engaging in side gigs, you can increase your overall cash flow and allocate more funds towards debt repayment.

One of the advantages of generating additional income is the ability to create a dedicated debt repayment fund. By earmarking the extra earnings specifically for paying off debts, you can make significant strides towards reducing your outstanding balances. This focused approach allows you to prioritize debt repayment without sacrificing your regular expenses or lifestyle.

Furthermore, increasing your income not only facilitates debt repayment but also enhances your financial resilience and stability. By diversifying your sources of income, you become less vulnerable to financial emergencies and setbacks, thus mitigating the risk of falling back into debt in the future. Ultimately, generating additional income is a proactive strategy that empowers you to take control of your financial situation and expedite your journey towards achieving debt freedom.

6. DEBT CONSOLIDATION:

Debt consolidation presents a streamlined approach to managing multiple debts by combining them into a single loan with a lower interest rate. This consolidation simplifies the repayment process, offering convenience and clarity in managing your financial obligations. By consolidating debts, you eliminate the need to track multiple due dates, minimum payments, and varying interest rates, which can reduce the likelihood of missed payments and late fees.

Additionally, one of the key advantages of debt consolidation is the potential for cost savings. By securing a loan with a lower interest rate compared to the average rate of your existing debts, you can significantly reduce the overall amount of interest paid over the loan term. This translates to more efficient debt repayment and frees up funds that can be directed towards other financial goals or used for building an emergency fund.

However, it’s essential to approach debt consolidation with careful consideration and a clear understanding of its implications. While it can offer benefits in terms of simplifying repayment and reducing interest costs, it’s important to weigh factors such as fees, repayment terms, and the impact on your credit score. By conducting thorough research and consulting with financial professionals, you can determine whether debt consolidation aligns with your financial objectives and contributes to your overall debt management strategy.

This no annual fee, cash back credit card from CapitalOne offers a great signup bonus

7. FINANCIAL COUNSELING:

Financial counseling offers invaluable support and guidance for individuals seeking to overcome debt challenges and regain financial stability. Professional financial counselors or advisors possess the expertise and resources to help you develop a personalized debt management plan tailored to your unique financial situation. By analyzing your income, expenses, and debts, they can offer insights and strategies to effectively reduce debt and achieve your financial goals.

One of the significant benefits of financial counseling is the access to expert advice and support. Counselors can offer objective perspectives on your financial situation, identify areas for improvement, and provide actionable steps to address your debt concerns. Whether it’s creating a budget, negotiating with creditors, or exploring debt consolidation options, they can guide you through the process and empower you to make informed decisions about your finances.

Furthermore, many nonprofit organizations offer free or low-cost financial counseling services, making professional assistance accessible to individuals regardless of their financial circumstances. These organizations are dedicated to promoting financial literacy and empowering individuals to take control of their finances. By taking advantage of these resources, you can gain the knowledge, skills, and confidence needed to overcome debt challenges and build a brighter financial future.

8. CUT UNNECESSARY EXPENSES:

Cutting unnecessary expenses is a fundamental strategy for freeing up additional funds to accelerate debt repayment. By scrutinizing your spending habits and identifying areas where you can trim costs, you can redirect those savings towards paying off your debts more quickly.

One effective approach is to prioritize essential expenses while minimizing discretionary spending. This might involve dining out less frequently, opting for homemade meals instead of restaurant outings, or packing lunches for work. Canceling subscription services for products or entertainment you rarely use can also yield significant savings over time. Additionally, exploring more cost-effective alternatives for goods and services, such as shopping for discounts or switching to generic brands, can further reduce expenses without sacrificing quality of life.

By making intentional choices to cut unnecessary expenses, you not only free up more money for debt repayment but also cultivate frugal habits that can benefit your financial well-being in the long run. Moreover, the process of evaluating and reducing expenses fosters mindfulness about your spending patterns, empowering you to make informed decisions that align with your financial goals and priorities.

How to Think Like a Millionaire

9. SNOWBALL OR AVALANCHE METHOD:

When tackling multiple debts, selecting the right repayment strategy can significantly impact your journey towards debt freedom. The snowball and avalanche methods are two popular approaches, each offering distinct advantages depending on your financial goals and psychological preferences.

The snowball method prioritizes paying off debts from smallest to largest balance, regardless of interest rates. By focusing on eliminating smaller debts first, you can experience quick wins and build momentum, which can be psychologically motivating. As you successfully pay off each debt, you gain a sense of accomplishment and confidence, spurring you to continue the debt repayment journey with renewed determination.

On the other hand, the avalanche method targets debts with the highest interest rates first, regardless of balance size. By prioritizing high-interest debts, you minimize the amount of interest accruing over time, potentially saving more money in the long run. While the avalanche method may not offer the immediate gratification of the snowball method, it can lead to faster overall debt reduction and greater cost savings.

Ultimately, the key to success lies in selecting the method that best aligns with your financial goals, personality, and preferences. Some individuals may prioritize psychological wins and motivation, making the snowball method more suitable, while others may prioritize minimizing interest costs, favoring the avalanche method. Regardless of the chosen approach, consistency and commitment are essential for achieving debt freedom.

10. EDUCATE YOURSELF:

Educating yourself about personal finance is akin to laying a sturdy foundation for your financial future. It empowers you to make informed decisions about budgeting, saving, investing, and debt management, thereby contributing to your long-term financial well-being. By immersing yourself in resources such as books, online courses, and workshops, you gain valuable insights and strategies to navigate the complexities of the financial world effectively.

With a solid understanding of financial principles, you can confidently tackle challenges such as debt repayment, retirement planning, and wealth accumulation. Moreover, financial education provides you with the tools to identify opportunities for growth and optimize your financial resources. Whether it’s maximizing your investment returns, minimizing expenses, or negotiating better terms with creditors, your knowledge empowers you to make strategic decisions that align with your goals.

Ultimately, investing in financial education is an investment in yourself and your future. It equips you with the skills and confidence needed to take control of your finances, overcome obstacles, and achieve financial independence. By continuously seeking knowledge and honing your financial literacy, you position yourself for greater success and security, ensuring a brighter financial outlook for years to come.

Crypto Ultimatum Training System

Conclusion:

Breaking free from debt requires dedication, strategic planning, and a willingness to make significant lifestyle changes. By adopting these ten effective strategies, individuals can take control of their finances, eliminate debt, and move towards a future of financial freedom and stability. Remember, the path to financial independence is a journey that requires persistence, but the rewards are well worth the effort.