In the pursuit of financial liberation, strategic budgeting, debt prioritization, and negotiation with creditors become paramount. Explore these ten tactics to break free from the shackles of debt.

Category: Debt

Empower future generations with financial literacy in schools. From budgeting to investing, it shapes informed decision-makers, fostering economic resilience and breaking the cycle of poverty for a prosperous society.

Liberate yourself from the shackles of mortgage debt with strategic approaches. Make extra payments, switch to biweekly schedules, and utilize windfalls to expedite your journey to mortgage freedom.

Recover from financial setbacks with resilience. Assess your situation, prioritize essentials, and diversify income. Professional advice, mindful spending, and financial education empower strategic rebuilding for long-term stability.

Embark on the journey to build credit from scratch by understanding credit basics, obtaining your credit report, and adopting responsible financial habits. Patience and consistency lead to financial empowerment.

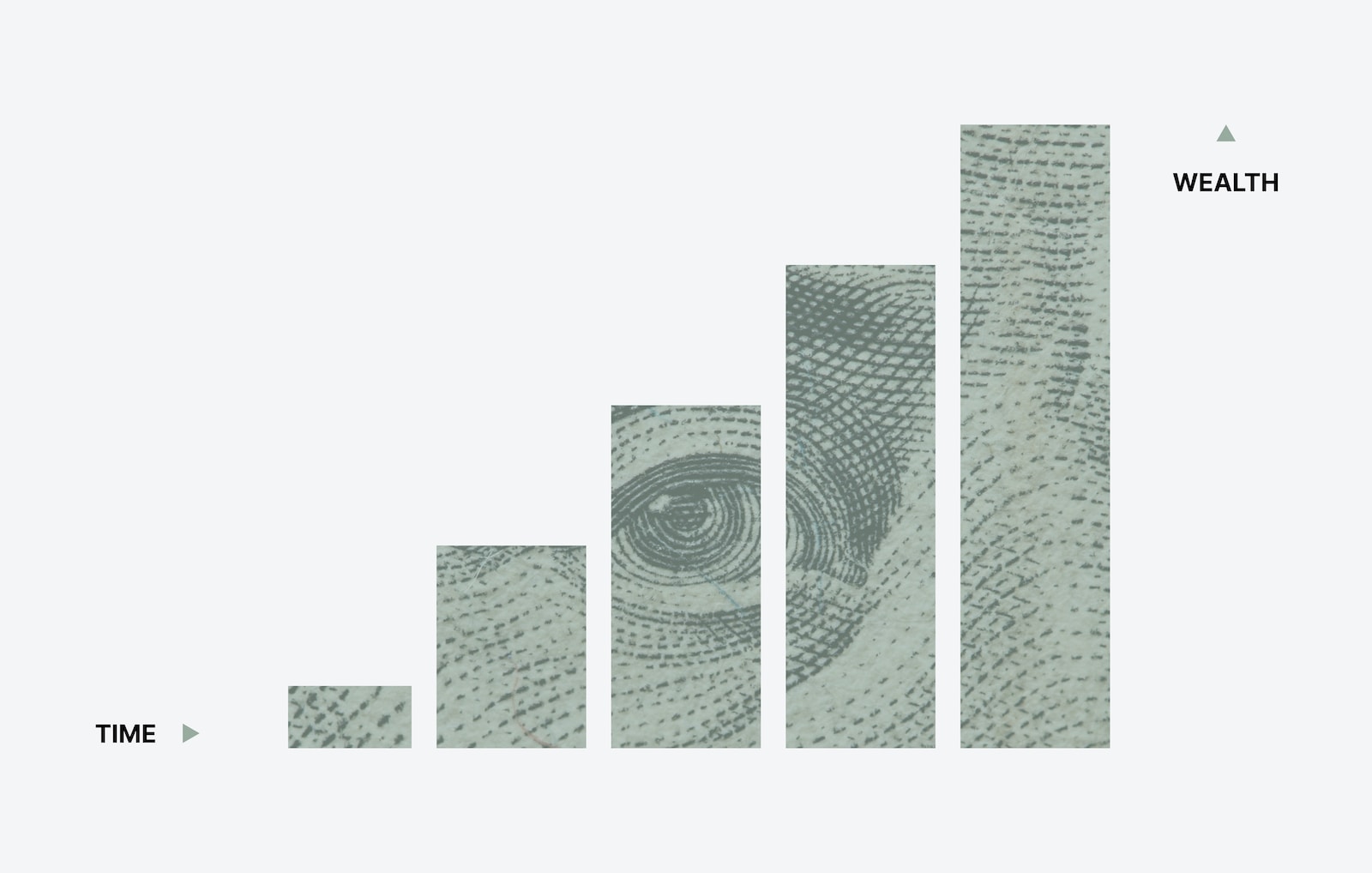

Master your financial journey by understanding and regularly calculating your net worth. This comprehensive guide unveils the essence of net worth, offering insights to enhance your financial health and empower informed decisions.

Discover effective strategies for paying off credit card debt and achieving financial freedom. From prioritizing high-interest debt to negotiating rates, this comprehensive guide empowers you to take control of your finances.

Embark on the journey to financial excellence with our guide on achieving a perfect credit score. Unlock insights into credit scoring, actionable steps, and strategies for maintaining pristine creditworthiness.

Mastering the art of everyday savings is a transformative journey toward financial empowerment. This guide unveils strategies for savvy shopping, and mindful spending. From slashing grocery bills to optimizing utility costs, these insights provide a roadmap to savings, ensuring your financial journey is marked by control, confidence, and long-term success.

Navigating the financial landscape, the Debt Avalanche Method presents a strategic approach to conquer debt. Contrasting the Snowball Method, it prioritizes high-interest debts, optimizing savings in the long run. Unveil the intricacies and benefits of this method, empowering your journey toward financial liberation.